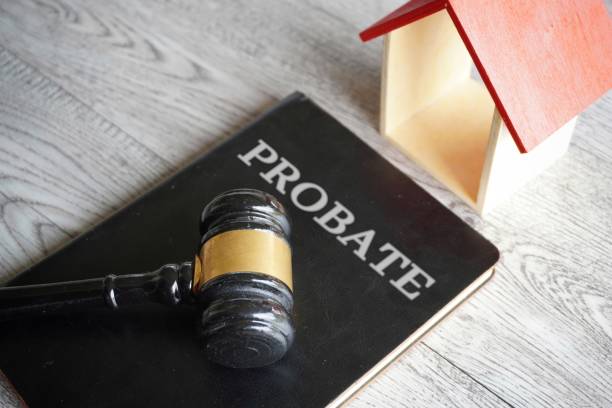

How do I know if I need to apply for Probate?

The first step is determining who the nominated executors are that have been appointed under the Will. It is the executors duty to determine the assets held by the deceased along with obtaining date of death values. This in turn will establish whether or not the Grant of Probate is required.